BMO Economics Housing Report

Vancouver housing market springs back to life.

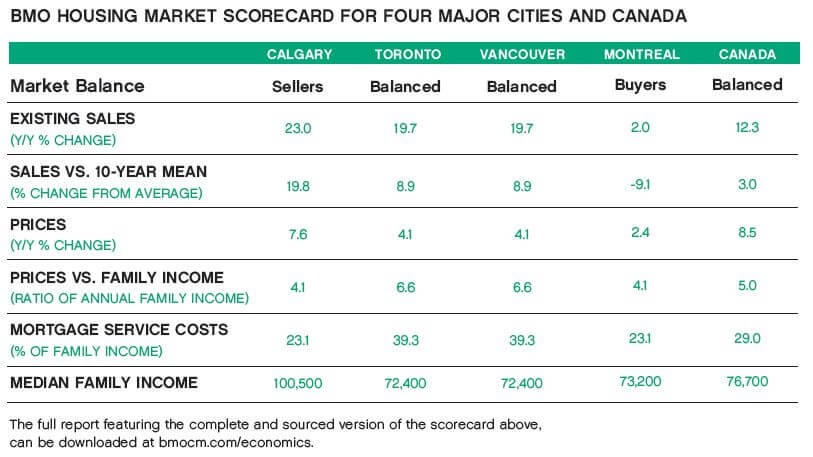

After a prolonged slide in sales and prices, the Vancouver housing market has swung from “buyers” status to “balanced”, according to a new report from BMO Economics on Canada’s major housing markets.

The report titled “Canadian Housing Update: Tale of Four Cities” examines the state of the housing markets in Canada’s four largest cities: Vancouver, Calgary, Montreal and Toronto.

“At the lowest point, sales were down 33 per cent year over year, but have since pole-vaulted 50 per cent to near-normal levels,” said Sal Guatieri, Senior Economist, BMO Capital Markets. “Buyers held the upper hand last year, but the pendulum has swung toward balanced today. New home inventories, normalized for population growth, are only moderately above long-term norms.”

Mr. Guatieri noted that last year’s price drop of 6 per cent pales in comparison with the average 22 per cent correction that Vancouver has suffered on four other occasions since 1980. “The worst was a 35 per cent slide in the early 1980s, while the other three corrections clocked in at 22 per cent in the late 1990s, 17 per cent in the early 1990s and 15 per cent in 2008. Whatever you want to say about Vancouver’s market, boring it’s not.”

The report showed that affordability continues to be a challenge for the Vancouver market, with benchmark prices still topping eight-times family income. “Detached house prices are likely to fall moderately when interest rates normalize and the opportunity cost of owning an expensive house goes up, while Vancouver’s detached house prices should decline moderately in the medium term,” stated Mr. Guatieri.

Meanwhile, condos will remain an affordable option for young buyers as prices have fallen slightly in the past year and are little changed from six years ago. “Mortgage service costs on a Vancouver condo consume 29 per cent of median family income, still within reach of most buyers,” said Mr. Guatieri. “We expect condo prices to remain flat in 2014, as healthy demographic demand from echo boomers and immigrants counters the downward pull of a moderately high number of vacant unsold units.”

Henry Donkers, Regional Vice President, Vancouver Westside and Richmond, BMO Bank of Montreal, reinforced the importance of ensuring long-term affordability when making a home financing decision.

“It’s prudent that prospective buyers work with their financial institution to stress test their mortgage against a higher interest rate to ensure long term affordability in the event that interest rates rise in the coming year as many expect is likely,” said Mr. Donkers.

Source: New Condo Guide

Original article: The Province

Read original aricle here.